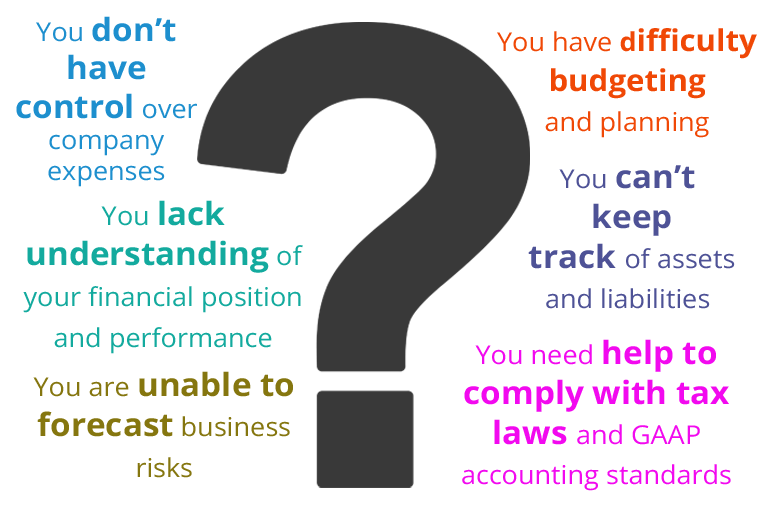

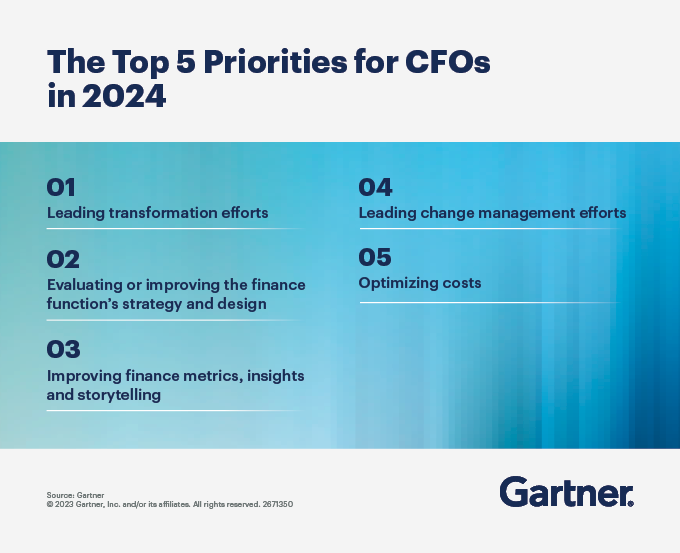

Financial management involves the process of planning, organizing, directing, and controlling an organization’s financial resources, from buying supplies to paying employees, optimizing funds, and investing the organization’s money. It also helps businesses make important financial decisions, improve profits, and secure opportunities.